In a world full of banking choices

We have just the best for you no matter what your needs are,

Be it your first time banking or just about trying something new and preferably better,

...we are here for you.

CHECKING ACCOUNTS

Choose from the best checking account options.

First Checking

Specially for first timers, this is a personal checking account with basic banking features.

- No Monthly Maintenance Fee

- No ATM Withdrawal fee

Ultimate Checking

Most selected checking account that comes with no overdraft fees and comes with extra credit card benefits.

- $15 Monthly Maintenance Fee

- Monthly Fee can't be waived

- No ATM Withdrawal fee

Grand Checking

As the name suggests, this is the top-tier checking with competitive rates and all the other perks this is a personal checking account with basic banking features.

- $30 Monthly Maintenance Fee

- ** Monthly Fee can be waived

- No ATM Withdrawal fee

Special Checking

For students, unemployed and those with special needs/considerations. This personal checking account comes with basic banking features and a specially tailored feature to serve the customer.

- No Monthly Maintenance Fee

- No ATM Withdrawal fee

SAVINGS

Get the best out of your money with our unmatched savings options

Standard Savings Account

Basic savings ideal for low balances and first-time savers

- No Monthly Maintenance Fee

- No ATM Withdrawal fee

Minimum opening deposit

$20

First Market Savings

Exclusive savings account for our First Checking Package customers

- No Monthly Maintenance Fee

- No ATM Withdrawal fee

Minimum opening deposit

$30

Ultimate Money Savings

Competitive savings account rates only for Ultimate Checking Package customers

- $0 Monthly Maintenance Fee

- No ATM Withdrawal fee

Minimum opening deposit

$60

Grand Market Savings

This is a top-tier savings with unmatched rates for Grand Checking Customers

- $50 Monthly Maintenance Fee

- ** Monthly Fee can be waived

- No ATM Withdrawal fee

Minimum opening deposit

$500

Special Money Market

An easy way to diversify your Bank portfolio with valuable tax advantages; may be for retirement or any other thing special to you

- No Monthly Maintenance Fee

- No ATM Withdrawal fee

Minimum opening deposit

$100

* Limits on savings withdrawals – Federal Regulation D limits certain types of withdrawals and transfers made from a savings or money market account to a combined total of six per account cycle. This includes withdrawals made by check or draft to third parties; debit or ATM card point-of-sale (POS) purchases; and pre-authorized withdrawals such as automatic transfers for overdraft protection and transfers made by telephone, online banking, mobile banking, bill pay, wire and facsimile. Withdrawals and/or transfers exceeding the six per account cycle allowance will result in a $15 excessive withdrawal fee per transaction. If limitations are continuously exceeded, the account may be converted to an First Checking account. Withdrawals and transfers made in person at our Bank branch or at an ATM are not included in the limit of six per account cycle.

Deposit products offered by Finansavings National Association. Member FDIC.

EasyCash Card

Welcome Offer

For a limited time, earn a $150 bonus after making $500 in eligible net purchases within the first 90 days of account opening.

Enjoy only 5% introductory APR on balance transfers for the first 12 billing cycles. After that the APR is variable.

Key benefits

Earn up to 25% cash back on your first $2,000 in combined eligible net purchases each quarter.

Annual fee

$0

JauntCash Card

Welcome Offer

Earn 50,000 bonus points worth $800 in travel redemption, just spend $4,500 in eligible Net Purchases within the first 90 days of account opening.

Key benefits

Earn 3X Points on travel and mobile wallet purchases. Plus, get reimbursed for up to $325 in eligible travel purchases annually.

Annual fee

$85;

Each additional card: $15 annually.

* We may change APRs, fees, and other Account terms in the future based on your experience with Finansavings National Association and its affiliates as provided under the Cardmember Agreement and applicable law.

MORTGAGE & REFINANCE

Best path for home related loans.

Buying a new home?

Whether you’re a first-time home buyer or you’ve done this before, we have you covered. Compare home loan rates and mortgage types, calculate numbers and see if you prequalify.

Reworking your current mortgage?

If you have long-term goals for your current home, refinancing your mortgage can help. See if you prequalify to lower your mortgage rates or monthly payments.

Unlock the value of your home

You’re in a good position if your home is worth more than you owe. See how home equity loans can be a smart choice.

* Loan approval is subject to credit approval and program guidelines. Not all loan programs are available in all states for all loan amounts. Interest rate and program terms are subject to change without notice.

INVESTING & RETIREMENT

we're here to help you evaluate investment and retirement options as you work toward your goals.

Prepare for retirement.

We make it easy for you to plan for retirement. Whether that's helping you choose an IRA or keeping track of all your finances – we can create a flexible retirement plan that adjusts as your needs evolve. We can help you with:

- Traditional IRAs, Roth IRAs and SEP IRAs

- Rollovers of 401(k), 403(b) and employer-sponsored plans

- Retirement planning and income

Open an IRA.

One of the best things you can do to save for retirement is to invest in an IRA. If you open one before July 15 you may be able to take advantage of tax benefits.

Ways to work with us

Whether you prefer investing online, want personalized financial planning guidance – or want a little of both – we have options to meet your needs.

Personal guidance

Making sense of your finances is our starting point for your personalized guidance. Whatever your financial situation, we will tailor a strategy to help you work toward your financial goals.

Online investing

Whether you want a managed-for-you option, Automated Investor, or you prefer to build and manage your own portfolio through Self-directed brokerage we've got an online investing option for you.

* Investment and Insurance products and services including annuities are:

Not a Deposit ● Not FDIC Insured ● May Lose Value ● Not Bank Guaranteed ● Not Insured by any Federal Government Agency

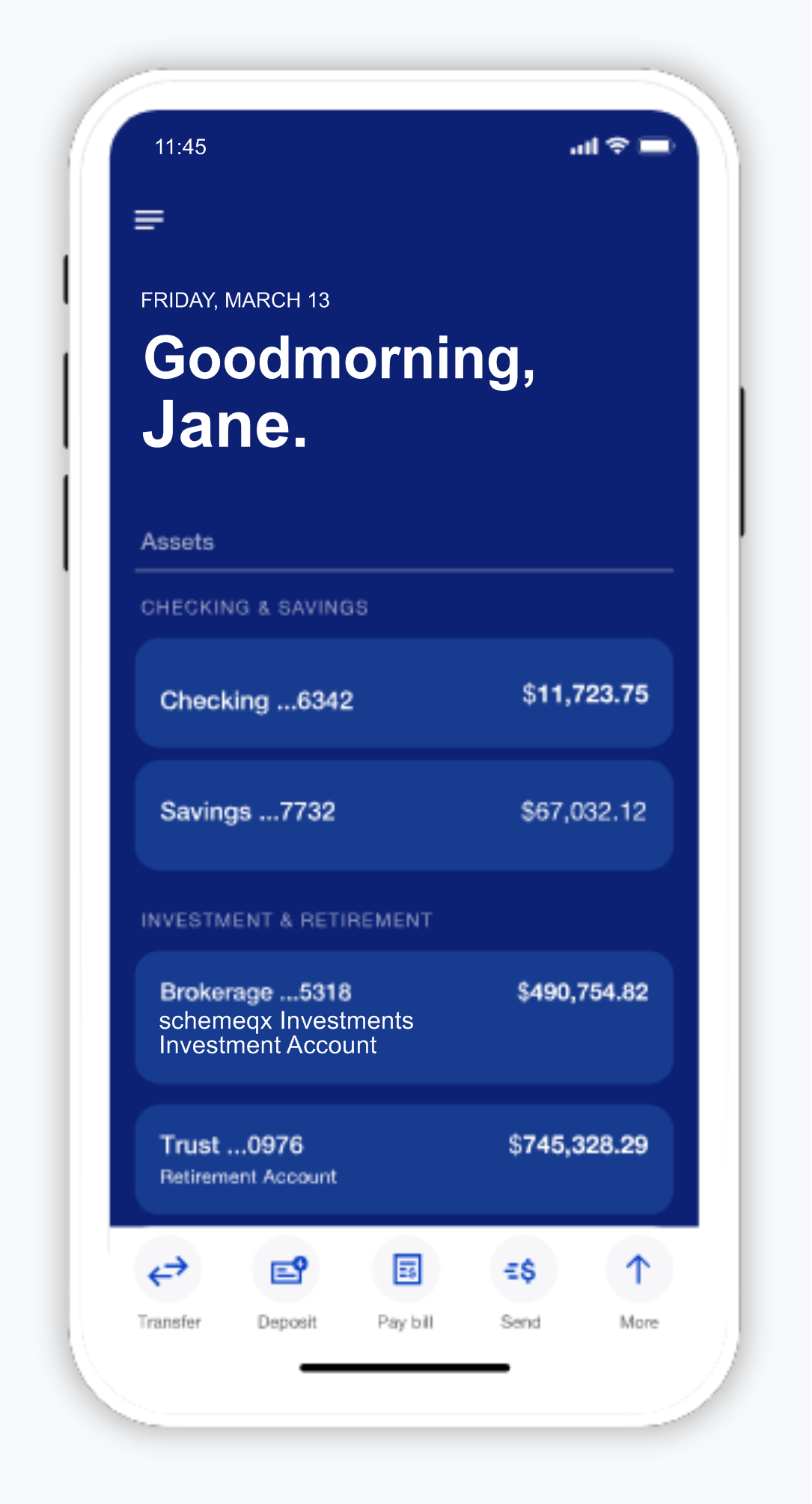

Bank on the go.

A mobile app that’s designed with you in mind

Bank from almost anywhere with the Finansavings Mobile App.

- — Transfer between your accounts.

- — Deposit checks.

- — Manage and pay bills.

- — Send, receive and request money.

$0 Fee ATMs

Withdraw from any ATM and you don't have to worry about any charges.

Online Banking

Get the information and features you need to manage your money on your computer screen.

Get Started

24/7 Email Support

Contact us at support@finansavings.com and we’ll connect you with the right banker.