Just starting out or have an established business?

Whatever you are looking for; Business Banking, Corporate & Commercial Banking, Investment Services... Count on us.

Count on Us

-

Our Business Banking Division offers multiple services to help manage your business needs. Servicing customers of any size, our unique blend of in-person branch services and digital tools are here to help you manage your business where you want, how you want.

-

Find financing, cash management, liquidity and international solutions to move your organization forward with a financial partner that understands your industry.

-

From global corporate trust needs to custody and fund servicing, plan your growth with customized and secure solutions.

BUSINESS ACCOUNTS

Business checking and savings that work for you

Account options designed with your business in mind

-

LENDING

Loans or lines for your business growth

-

POWER PAYMENTS

Payment solutions to help your business

Get the right business banking services for your organization’s needs.

Small businesses

Whether you’re just starting out or are established with up to $10MM in annual revenue, we offer a unique blend of branch services and digital tools to help you manage your small business banking needs.

Scale-up businesses

As your revenue grows, so do your scale-up business’s financial needs. We’re ready to support your growth with everything from financing to more customized payment services.

Mid-sized companies

If your company has an annual revenue from $10MM to $500MM, receive customized service from our commercial banking division as you work toward your financial and operational goals.

Large corporations

For large public or private firms with annual revenues greater than $500MM, our corporate banking division provides relationship managers to serve as your specialized financial partner.

Corporate & Commercial Banking

● Capital Markets ● Credit and Financing ● International Services ● Liquidity and Investments ● Payables and Receivables

Expertise to help you achieve your goals

We're here to help you drive speed and efficiency in your financial operation and succeed in a fast-changing, competitive market.

-

Manage your business

Support your business with key insights every step of the way.

-

Improve your operations

Tackle large enterprise and institutional issues head-on.

-

Plan your growth

Help your business realize its full potential.

Achieve your business goals at every stage of your journey

You need a financial partner that understands your business. We’re here to help you withstand economic fluctuations and succeed in a fast-changing, competitive market. Count on us to guide you through financial challenges, so you can focus on the critical journey ahead.

Explore capital markets

Get solutions to meet your capital requirements. Let our experts help you fund strategic growth, optimize capital structure, and manage interest rate and currency risk.

Find credit and financing

Manage your short- and long-term cash flow needs. Let us help you facilitate growth and operations, finance equipment and fund community projects.

Execute an international strategy

Find guidance on managing liquidity and payables, expanding your business, mitigating currency risk and facilitating trade.

Optimize liquidity and investments

Find a solution to match your investment philosophy. We can help you manage deposits and liquidity, mitigate fraud and investment risk and maximize returns on account balances.

Manage payables and receivables

Make the most of your working capital. We can show you ways to control and accept payments, manage spend and accelerate receivables.

Get industry expertise

Work with an industry expert who knows key regulatory and market trends impacting your bottom line.

INVESTMENT SERVICES

Why choose Investment Services from us?

Make us your partner and we’ll use our entire suite of services to support your local, national or international needs while helping foster your future growth.

-

Committed to your best interests

We keep to the highest standards of ethics, security and transparency. We take pride in maintaining this reputation and constantly backing it up.

-

Providing seamless delivery

Our expertise, experience and technology help us consistently deliver with the highest quality.

-

Tailored to your needs

We spend time learning what you need, instead of trying to fit you into an existing box. We work with you to craft flexible solutions that add value above and beyond.

-

Offering proactive support

People make the difference. We work to help you move forward, offering new ideas and potential opportunities along the way.

Plan for the bigger picture.

Custody solutions

We use our financial strength and expert resources to create custody solutions. Focused on your specific needs, we maintain the highest standards of ethics, security and transparency.

Corporate trust

With expertise drawn from a tradition of market leadership, we provide consistent guidance and industry-leading technology to keep you moving forward.

Fund services

We support even the most complex products and client needs through client-centered service and customized solutions. As you grow, we’re here to help you take the next step.

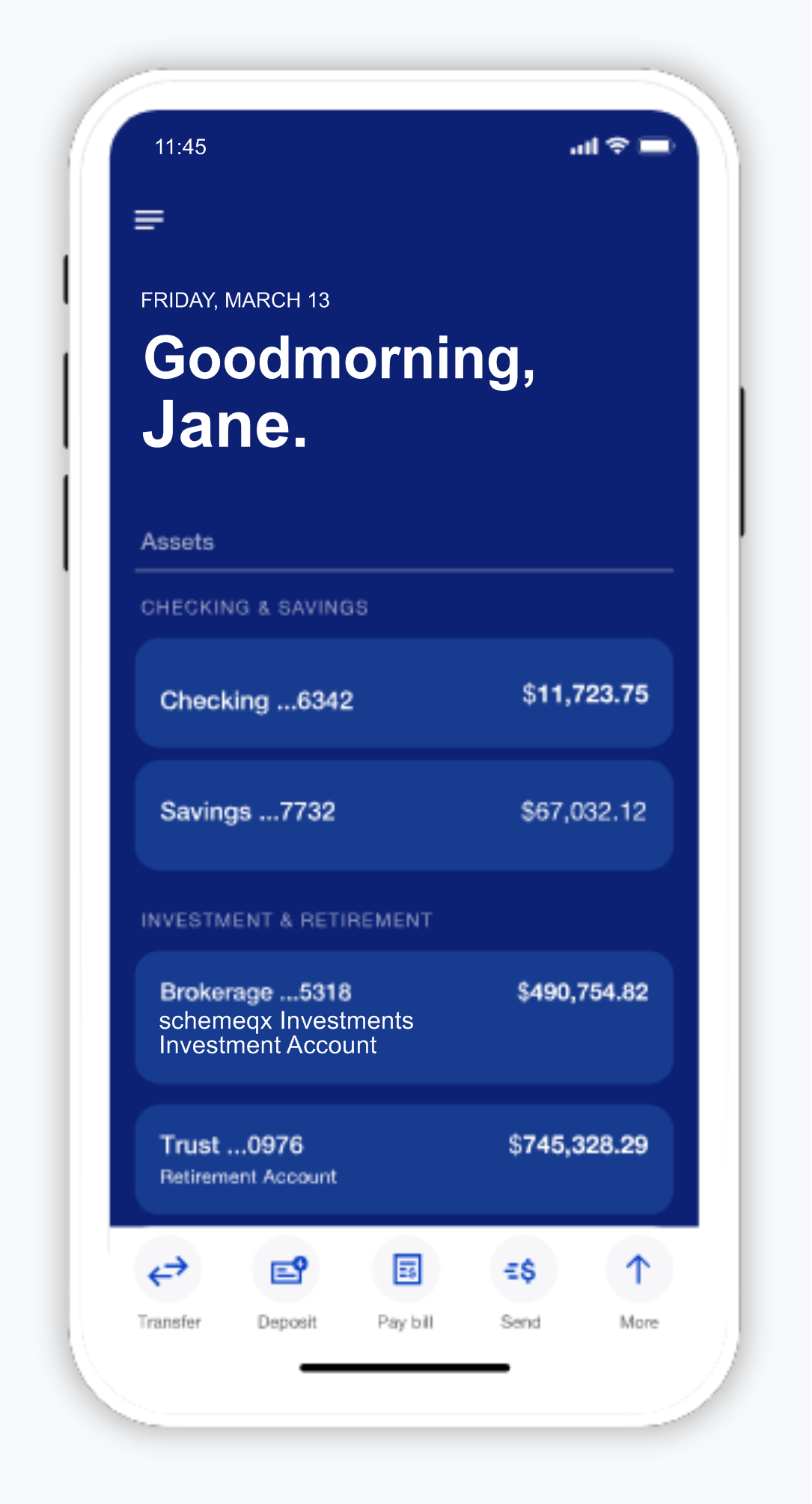

Bank on the go.

A mobile app that’s designed with you in mind

Bank from almost anywhere with the Finansavings Mobile App.

- — Transfer between your accounts.

- — Deposit checks.

- — Manage and pay bills.

- — Send, receive and request money.

$0 Fee ATMs

Withdraw from any ATM and you don't have to worry about any charges.

Online Banking

Get the information and features you need to manage your money on your computer screen.

Get Started

24/7 Email Support

Contact us at support@finansavings.com and we’ll connect you with the right banker.